The number rose by nearly 34% in the assessment year 2021-22 from the 441 such entities which filed returns of over Rs 500 crore.Approximately 1.6 crore taxpayers paid taxes but did not file returns for AY 2020-21, the data showed. Nearly 6.7 crore returns were filed during this period.

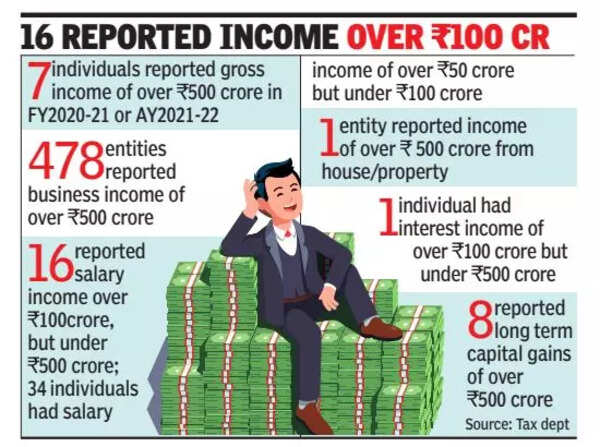

Direct taxes comprise income and corporation taxes with 554 of the 589 being companies that filed returns of gross total income of over Rs 500 crore. In the previous year, there were 413 such companies. In contrast, the number of individuals reporting over Rs 500 crore gross income fell from 12 in AY2020-21 to seven in AY2021-22. HUFs, firms, association of persons and others made up the rest of the 589. The statistics were generated from e-filed returns up to March 31, 2023, the department said.

Tax experts attributed the surge in returns and incomes to robust economic growth, rising corporate profits, higher household incomes and better use of big data and technology by tax authorities.

‘Tech usage boosts growth of direct tax collections’

There are two or three key reasons for this. One is that corporate profits have been robust and they have grown in the past few years. There has also been an increase in the number of households with Rs 10 lakh income – in fact they have grown three times over the past four years,” said Dinesh Kanabar, chief executive officer of Dhruva Advisors.

“Direct tax collections have also grown due to a greater formalisation of the economy and the tax department is using technology including big data. Every transaction is taxed and there is now tax collection at source even for overseas travel,” said Kanabar.

R Prasad, former chairman of the Central Board of Direct Taxes, attributed the improvement to corporate profits. He also said that tax deducted at source accounted for nearly 45% of direct tax receipts.

The tax department has undertaken a string of measures to boost receipts and plug loopholes. The use of GST data has also helped the income tax department to match numbers.

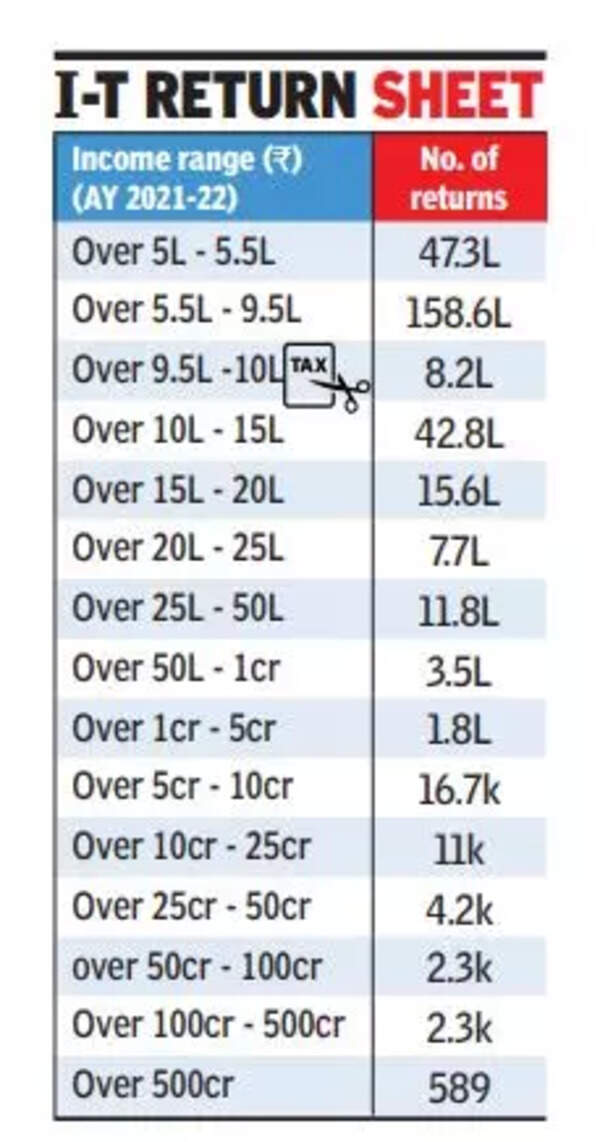

Latest data showed that income tax returns filed by individual taxpayers have increased by 90% between 2013-14 and 2021-22. The data showed that returns filed by individual taxpayers increased from 3.4 crore in the assessment year 2013-14 to 6.4 crore in 2021-22. During the current fiscal too, 7.4 crore returns have been filed for assessment year (AY) 2023-24 till date, including 53 lakh new filers.