- Preliminary budget statement says the government expects total revenues at 1.172 trillion riyals ($312.51 billion) in 2024 and total spending of 1.251 trillion riyals

Arab News

RIYADH: Saudi Arabia has lowered its growth forecast and expects to post a budget deficit this year rather than an earlier projected surplus, a preliminary budget statement showed on Saturday.

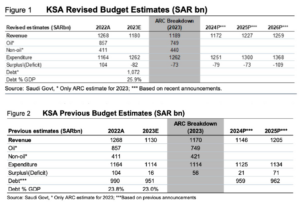

The largest Arab economy expects real gross domestic product to grow by 0.03 percent this year, the document released by the Ministry of Finance showed, compared with a previous forecast for growth of 3.1 percent.

The report said the government is also now expecting a SAR82 billion deficit for 2023 instead of a SAR16bn surplus projected earlier.

For 2024, the government expects total revenues at 1.172 trillion riyals ($312.51 billion) and total spending of 1.251 trillion riyals. An earlier projection put revenue this year at 1.130 trillion riyals and spending at 1.114 trillion riyals.

Saudi Arabia has sharply cut its oil production for what the world’s largest oil exporter says is meant to stabilize the oil market. Oil prices remain below last year’s average of $100 a barrel.

The document also projected the government would post a budget deficit of 1.9 percent of GDP in 2024, 1.6 percent of GDP in 2025 and 2.3 percent of GDP in 2026. It said “limited budget deficits” would continue in the medium term due to expansionary spending policies and conservative revenue estimates.

Real GDP was projected to grow by 4.4 percent in 2024, 5.7 percent in 2025 and 5.1 percent in 2026.

Saudi Arabia’s economy grew 8.7 percent last year on the back of high oil prices, allowing it to record its first budget surplus in almost a decade.

Commenting on the revised projections, Alrajhi Capital said the “increased spending by the government is not only driven by higher revenues but also supported by additional debt levels.”

“For 2023, we reiterate that oil revenues could reach SAR749bn led by Aramco’s recent hike in PLD. Nevertheless, we increase our expectations for non-oil revenues at SAR440bn (versus the earlier estimates of SAR421bn) as H1 2023 non-oil revenues have already surpassed that of H1 2022, led by traction in non-oil GDP growth,” it said.

“Furthermore, as per IMF Country Report the non-oil GDP growth is expected to comfortably stay above the 4% mark in the near future. We believe this will underpin higher spending by the Government going forward.

“Acceleration of spending (SAR1,262bn versus SAR1,114bn) can be regarded as a strategic move by the Government and is reflective of its support towards the Vision 2030 target. We believe Government spending to play a pivotal role in realizations of Vision 2030 objectives,” Alrajhi Capital said.

“In our view the government will manage to maintain healthy reserve levels (SAR410mn as of 2Q2023) and will support spending by way of higher non-oil revenues and increased leverage,” it further said.

(With Reuters)